Anti-Money Laundering in Reconciliation - AML Monitoring

Comprehensive anti-money laundering integration within payment reconciliation processes. Automated suspicious activity detection, real-time transaction monitoring, compliance reporting, and risk-based customer screening for enhanced AML protection.

See ReconcileOS in Action

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Everything you need to automate reconciliation

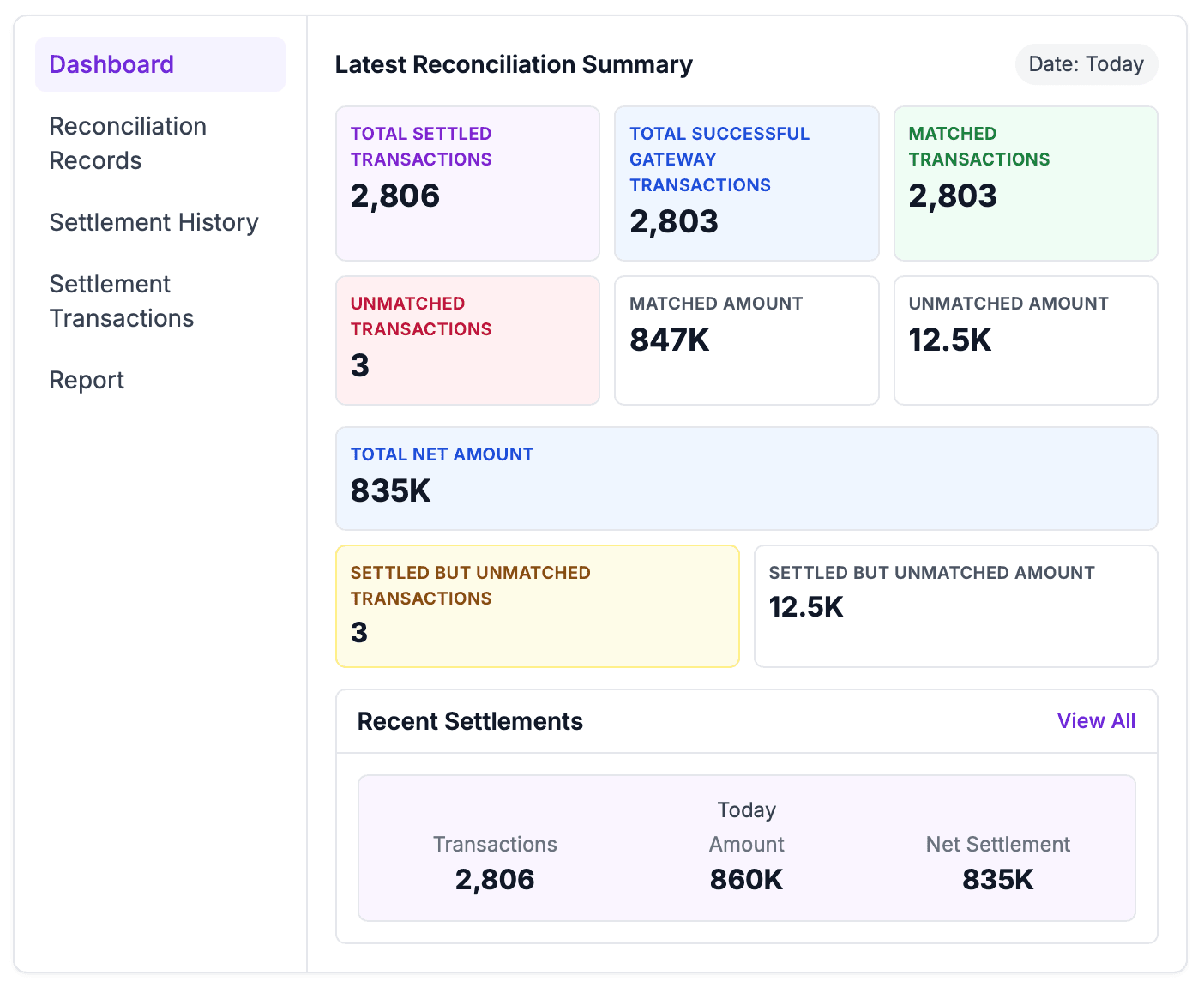

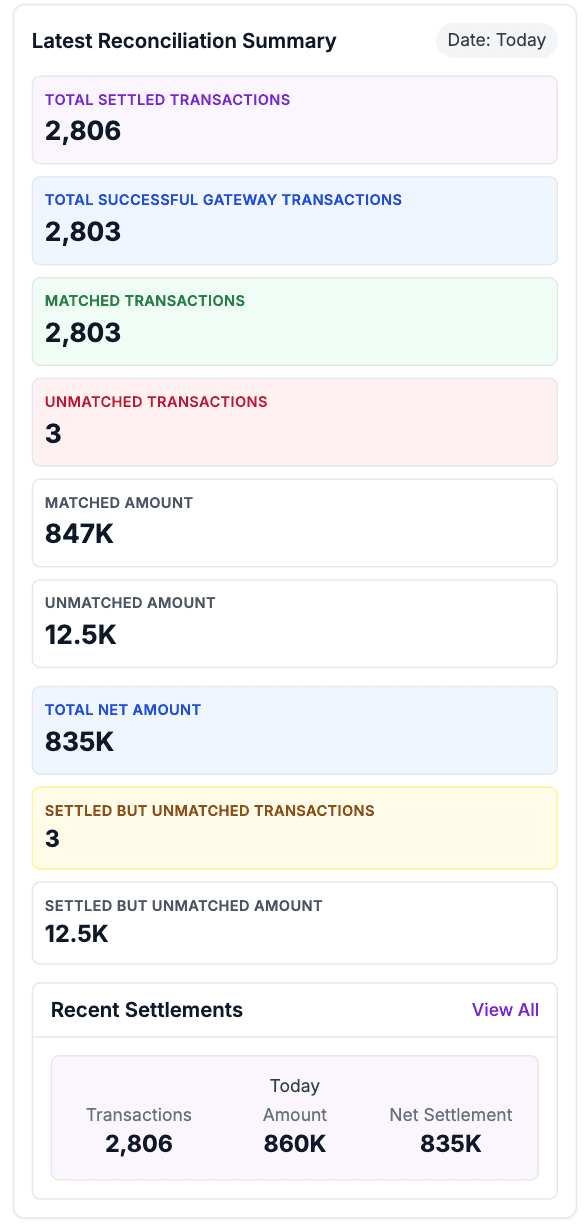

Match gateway, bank, and ledger data automatically. Review only exceptions.

Settlement Transactions

Four‑way matching across gateway files, bank statements, ledger entries, and orders.

Settlement History

Daily close with variances highlighted and net settlement computed automatically.

Reconciliation Records

Audit‑ready trails with exports. Every match and adjustment is logged.

Reports

Scheduled PDF/CSV delivery and ERP‑friendly exports.

Real-time Processing

Instant transaction processing with immediate exception detection and alerts.

Enterprise Security

Bank-grade security with encrypted data transmission and access controls.

Works with your existing tools

Connect payment gateways, banks, and accounting software in minutes—no complex setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Payment Gateway Reconciliation Software | UAE Automated

Universal Payment Gateway Integration & Reconciliation Hub

FATF Compliance for Payment Processing - Anti-Money Laundering

FATF-Compliant Payment Reconciliation and Monitoring

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

How does anti-money laundering integration work within payment reconciliation systems?

Anti-money laundering reconciliation provides comprehensive AML integration within payment reconciliation processes. Our AML payment monitoring platform includes automated suspicious activity detection, real-time transaction screening, compliance reporting, and risk-based customer assessment for enhanced AML protection.

What types of suspicious activities can the AML system detect during reconciliation?

Our suspicious activity detection system identifies unusual transaction patterns, structuring attempts, rapid movement of funds, transactions with high-risk jurisdictions, politically exposed persons (PEP) activities, and other indicators of potential money laundering during the reconciliation process.

How does the platform handle customer risk assessment and scoring?

Our compliance risk management system automatically assesses customer risk based on transaction history, geographic factors, business type, transaction volumes, and other risk indicators, providing dynamic risk scoring and appropriate monitoring levels.

Can the AML system generate regulatory reports for UAE authorities?

Yes, our platform automatically generates Suspicious Transaction Reports (STRs), AML compliance reports, customer due diligence documentation, and other regulatory submissions required by UAE Financial Intelligence Unit and Central Bank.

How does transaction screening work for real-time AML monitoring?

Our transaction screening automation platform screens all transactions in real-time against sanctions lists, PEP databases, high-risk jurisdiction lists, and other watch lists, providing immediate alerts for transactions requiring enhanced scrutiny.

Is the AML reconciliation system compliant with international standards?

Yes, our platform complies with FATF recommendations, UAE AML/CFT regulations, international sanctions regimes, and global AML best practices, ensuring comprehensive compliance for businesses operating in multiple jurisdictions.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

Payment Reconciliation Software | UAE Automated Solution

Best Payment Reconciliation Software for UAE Businesses

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses