UAE's #1 Payment Reconciliation Platform

UAE's leading payment reconciliation platform. Automate PayTabs, Telr, Network International reconciliation. Comprehensive settlement automation for Dubai and Abu Dhabi businesses. Payment reconciliation software, settlement reconciliation, and payment processing reconciliation all in one platform. AED support, VAT compliance, local banking integration. Reduce reconciliation time by 90%.

See ReconcileOS in Action

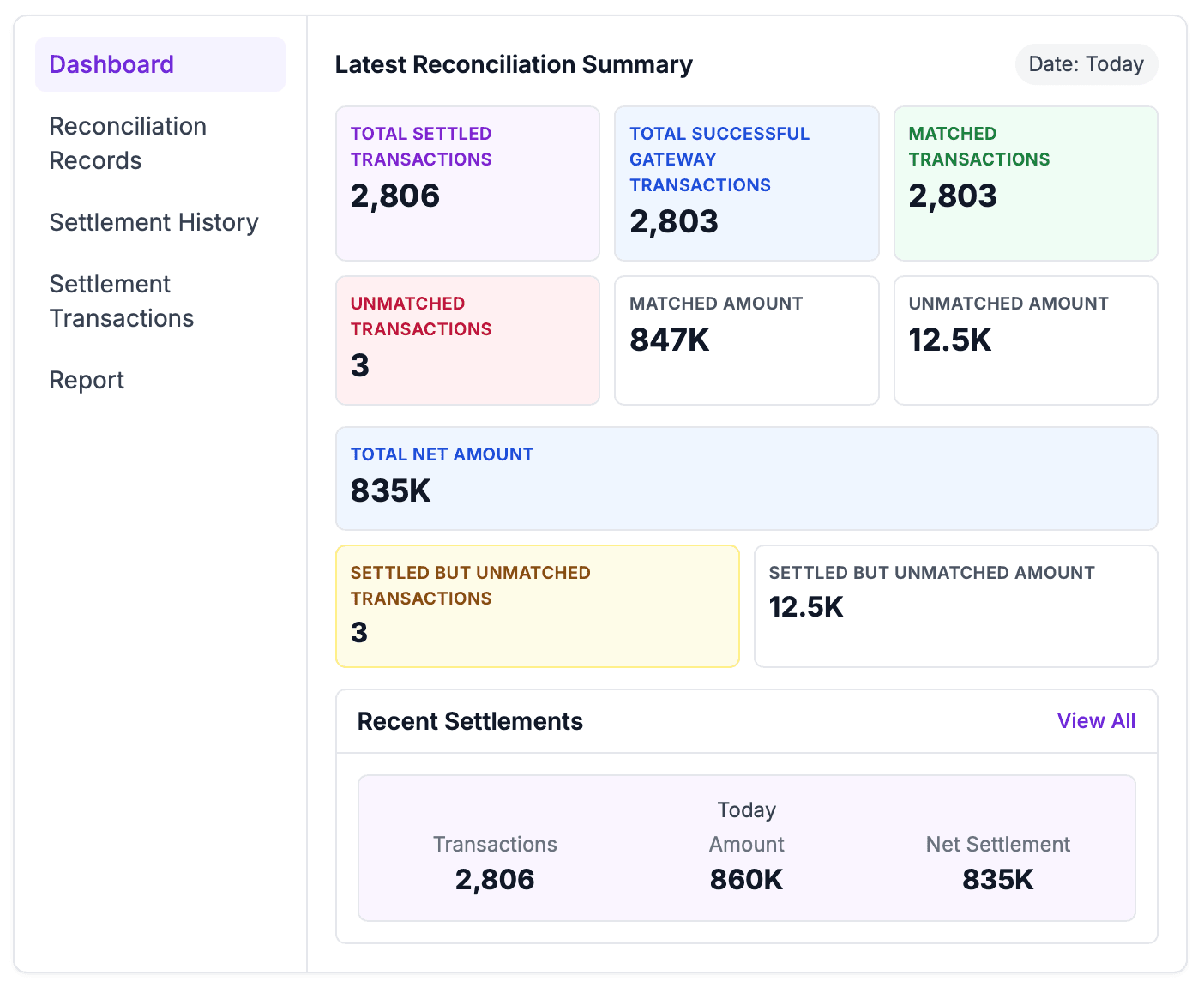

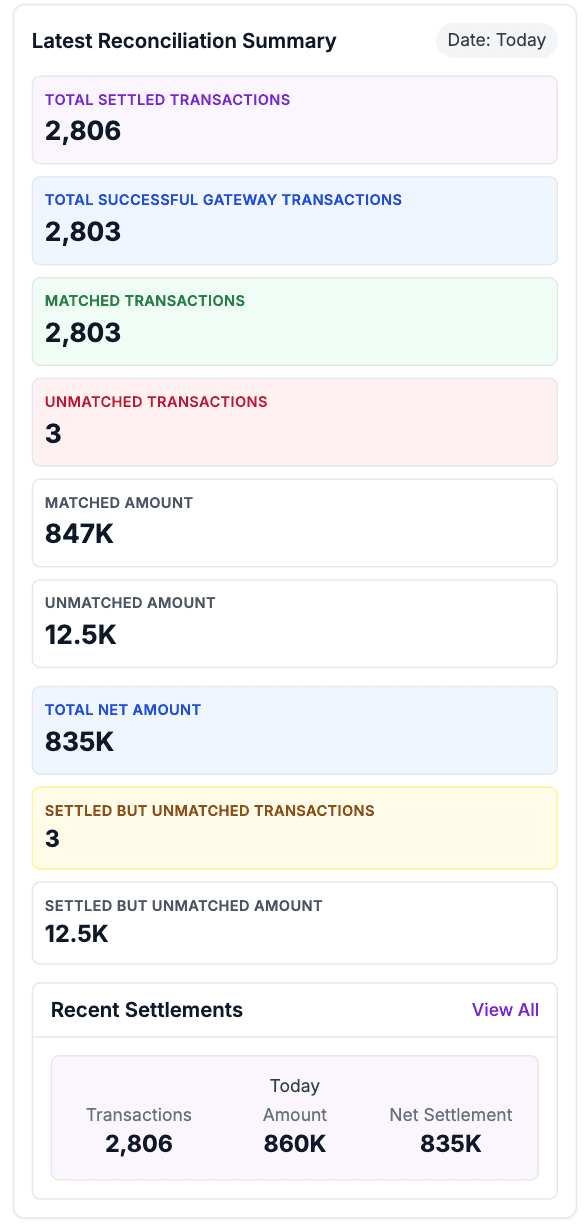

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Complete UAE payment reconciliation automation

Automatically match PayTabs, Telr, and Network International transactions with UAE bank settlements. VAT compliant and audit-ready.

UAE Gateway Matching

Automated matching across PayTabs, Telr, Network International files with Emirates NBD, FAB, and ADCB statements.

AED Settlement Tracking

Real-time AED settlement monitoring with automatic variance detection and Central Bank compliance.

UAE Audit Trails

FTA-compliant audit trails with Dubai Municipality and Abu Dhabi Department of Finance export formats.

UAE Compliance Reports

Automated VAT reports, Central Bank filings, and Dubai Financial Services Authority submissions.

Seamlessly integrates with UAE financial ecosystem

Pre-built connections to major UAE payment gateways, banks, and accounting systems for instant setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Payment Gateway Reconciliation Software | UAE Automated

Universal Payment Gateway Integration & Reconciliation Hub

Enterprise Banking Reconciliation Hub for UAE Banks

Complete Banking Reconciliation Solutions & Core Banking Integration

E-commerce & Retail Payment Reconciliation Hub

Complete E-commerce, Retail & Multi-Channel Payment Reconciliation

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

What is payment reconciliation specifically for the UAE?

Payment reconciliation UAE is the process of matching transactions from UAE payment gateways (like PayTabs, Telr, Network International) with bank settlements, ensuring compliance with UAE Central Bank regulations and VAT laws. Our settlement reconciliation software automates this entire process.

Which UAE payment gateways do you support?

We support all major UAE payment gateways, including PayTabs, Telr, Network International, Checkout.com, Magnati, and more, ensuring complete coverage for your UAE fintech solutions and Dubai payment processing needs.

How does your platform handle AED and multi-currency transactions?

Our transaction matching platform is built to handle AED transactions natively and supports multi-currency reconciliation, applying correct conversion rates and accounting for international fees. Perfect for Middle East payment systems.

Is the reconciliation process compliant with UAE VAT laws?

Yes, our automated reconciliation system automates VAT calculations on transactions and generates reports that are compliant with the UAE's Federal Tax Authority (FTA) requirements and UAE Central Bank regulations.

Can this system integrate with accounting software used in the UAE?

Absolutely. We offer seamless integrations with popular accounting software in the UAE, including Tally, Zoho Books, and QuickBooks, to ensure your financial data automation and bank reconciliation software needs are met.

What makes your payment gateway reconciliation different?

Our payment gateway reconciliation platform offers real-time webhook integration, automated PDF processing for settlement files, and advanced transaction matching with auth codes and card details. We're the leading UAE payment reconciliation software.

How does your e-commerce reconciliation work?

Our e-commerce reconciliation solution provides online payment matching for Dubai retail businesses, merchant reconciliation with comprehensive reporting, and payment gateway integration for UAE e-commerce platforms.

Is your platform PCI DSS compliant for secure payment processing?

Yes, our PCI DSS reconciliation software ensures secure payment processing with financial data security. We maintain the highest standards for regulatory compliance software in the UAE financial technology sector.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

Payment Reconciliation Software | UAE Automated Solution

Best Payment Reconciliation Software for UAE Businesses

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses

Enterprise Banking Reconciliation Hub for UAE Banks

Complete Banking Reconciliation Solutions & Core Banking Integration