DeFi Protocol Reconciliation - Decentralized Finance

Sophisticated DeFi protocol reconciliation for decentralized finance platforms. Track liquidity pool transactions, yield farming rewards, governance token distributions, automated market maker fees, and complex DeFi protocol interactions.

See ReconcileOS in Action

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Everything you need to automate reconciliation

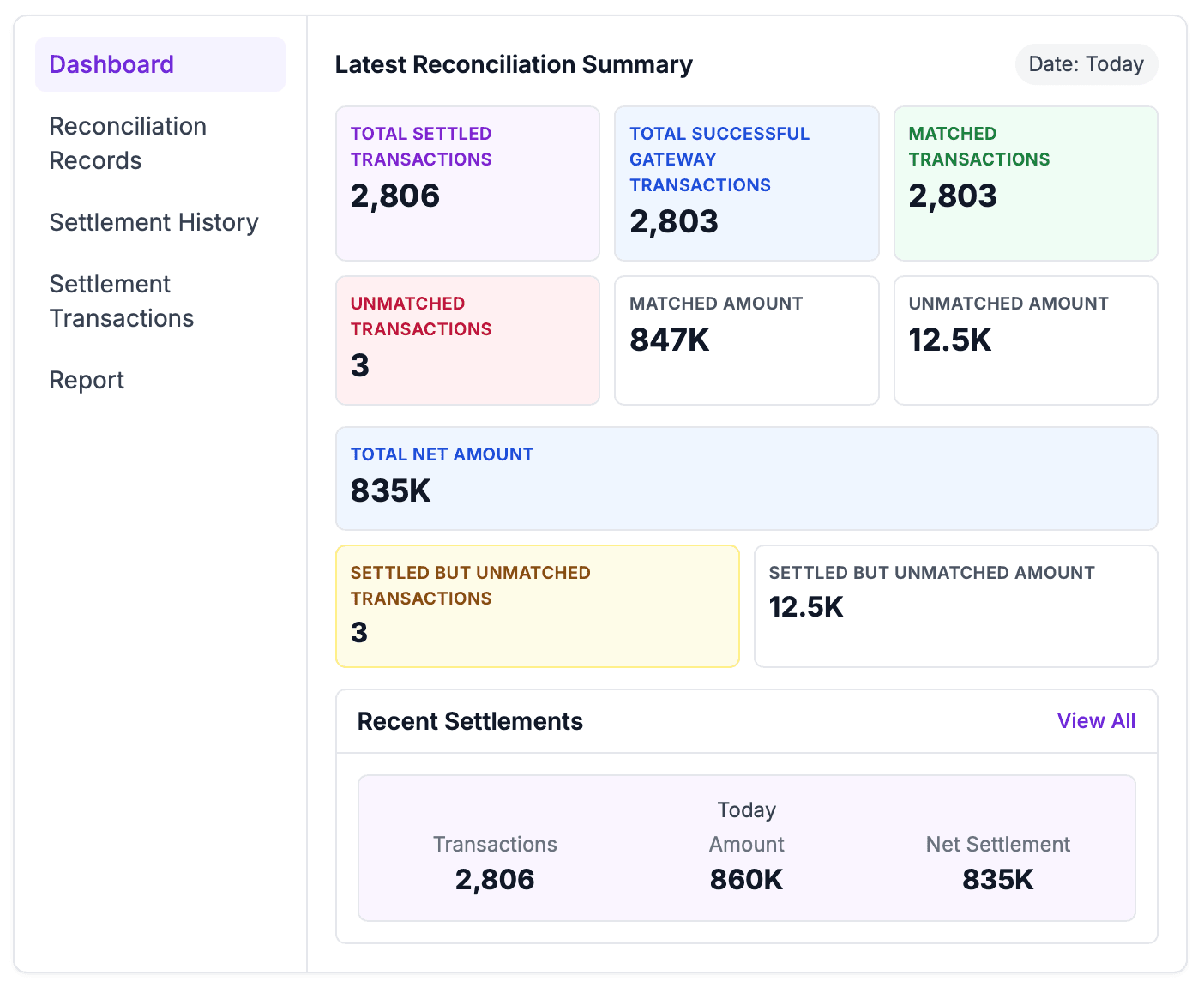

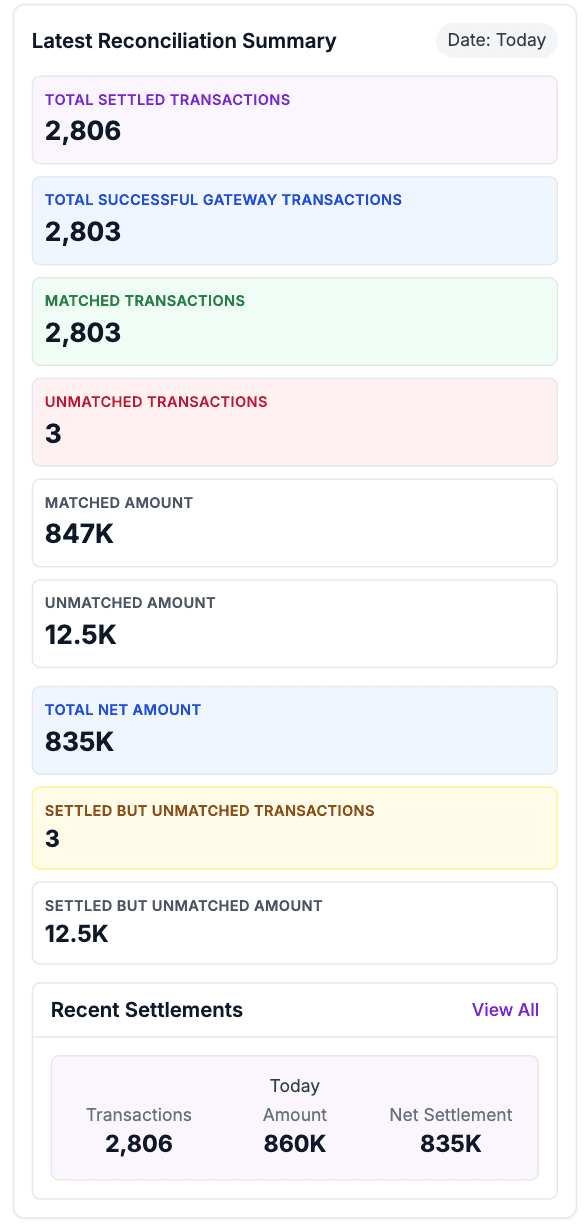

Match gateway, bank, and ledger data automatically. Review only exceptions.

Settlement Transactions

Four‑way matching across gateway files, bank statements, ledger entries, and orders.

Settlement History

Daily close with variances highlighted and net settlement computed automatically.

Reconciliation Records

Audit‑ready trails with exports. Every match and adjustment is logged.

Reports

Scheduled PDF/CSV delivery and ERP‑friendly exports.

Real-time Processing

Instant transaction processing with immediate exception detection and alerts.

Enterprise Security

Bank-grade security with encrypted data transmission and access controls.

Works with your existing tools

Connect payment gateways, banks, and accounting software in minutes—no complex setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Payment Gateway Reconciliation Software | UAE Automated

Universal Payment Gateway Integration & Reconciliation Hub

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Enterprise Banking Reconciliation Hub for UAE Banks

Complete Banking Reconciliation Solutions & Core Banking Integration

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

How does DeFi protocol reconciliation work for decentralized finance platforms?

DeFi protocol reconciliation provides sophisticated tracking for decentralized finance platforms. Our decentralized finance automation platform tracks liquidity pool transactions, yield farming rewards, governance token distributions, automated market maker fees, and complex DeFi protocol interactions.

Which DeFi protocols are supported for reconciliation?

We support major DeFi protocols including Uniswap, SushiSwap, Aave, Compound, MakerDAO, Curve Finance, and other leading decentralized finance platforms. Our liquidity pool tracking system provides comprehensive reconciliation across the DeFi ecosystem.

How does the platform track yield farming rewards and staking income?

Our yield farming reconciliation system automatically tracks staking rewards, liquidity mining incentives, governance token distributions, and yield farming returns. The platform provides detailed reporting for all DeFi income streams and tax reporting requirements.

Can the system handle complex DeFi transactions like flash loans and arbitrage?

Yes, our platform tracks complex DeFi transactions including flash loans, arbitrage opportunities, multi-protocol interactions, and automated trading strategies. We provide detailed reconciliation for sophisticated DeFi trading activities.

How does DeFi reconciliation handle impermanent loss and liquidity provider fees?

Our system calculates impermanent loss, tracks liquidity provider fees, monitors pool performance, and provides detailed analysis of liquidity provision outcomes. Users receive comprehensive reporting on DeFi investment performance.

Is DeFi protocol reconciliation compliant with tax reporting requirements?

Yes, our platform generates tax-compliant reports for DeFi activities, tracks cost basis for token transactions, calculates realized gains and losses, and provides documentation required for cryptocurrency tax reporting in the UAE and internationally.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

Payment Reconciliation Software | UAE Automated Solution

Best Payment Reconciliation Software for UAE Businesses

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses