Free Zone Payment Reconciliation - UAE Free Zone Solutions

Tailored free zone payment reconciliation for UAE free zone enterprises. Handle cross-border transactions, multi-currency operations, free zone regulatory compliance, tax-efficient payment processing, and specialized reporting for free zone businesses.

See ReconcileOS in Action

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

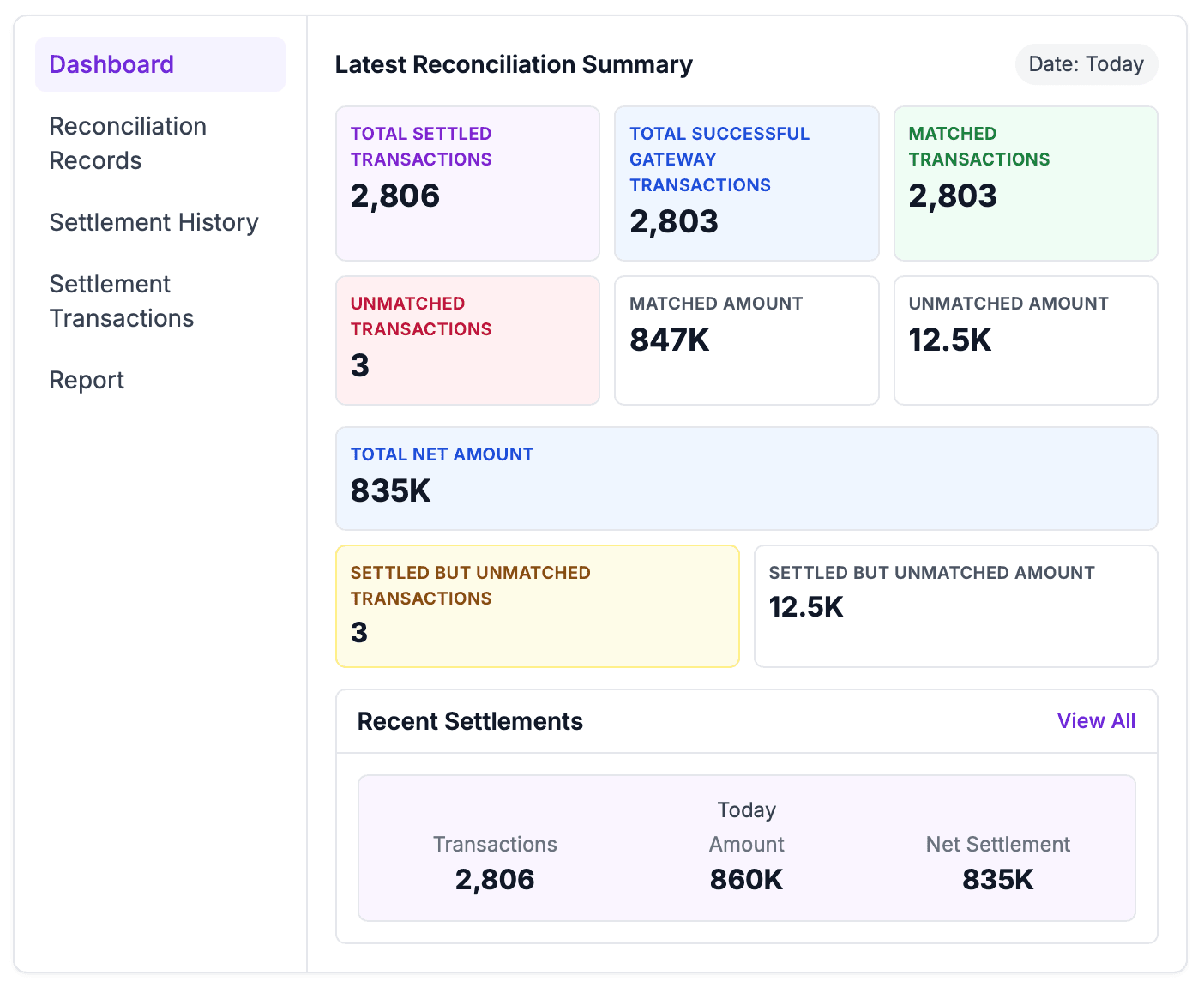

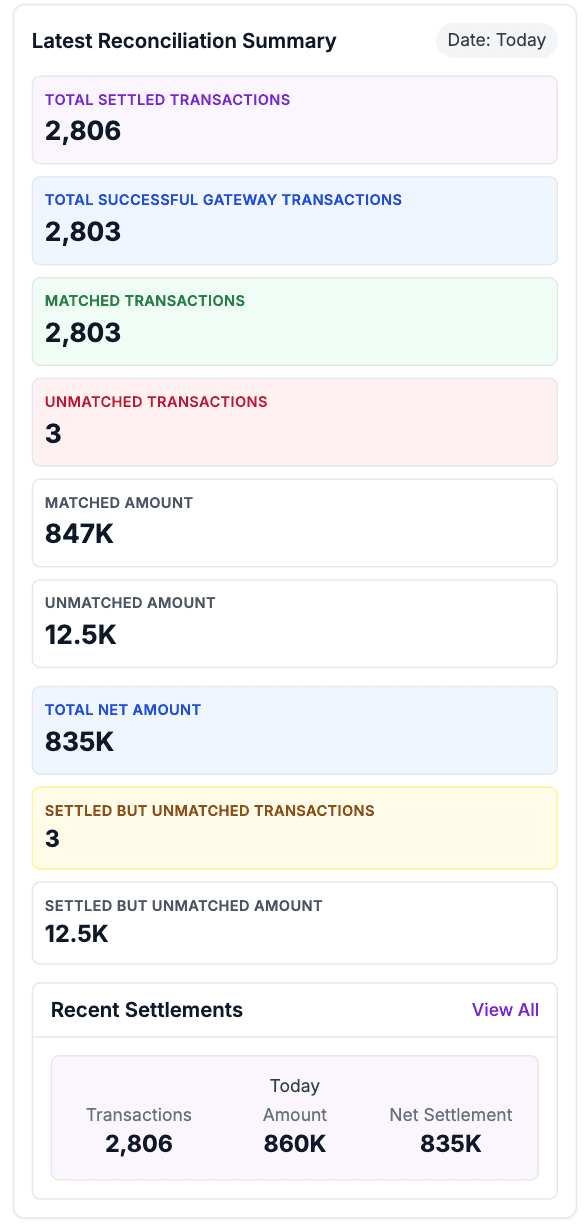

Everything you need to automate reconciliation

Match gateway, bank, and ledger data automatically. Review only exceptions.

Settlement Transactions

Four‑way matching across gateway files, bank statements, ledger entries, and orders.

Settlement History

Daily close with variances highlighted and net settlement computed automatically.

Reconciliation Records

Audit‑ready trails with exports. Every match and adjustment is logged.

Reports

Scheduled PDF/CSV delivery and ERP‑friendly exports.

Real-time Processing

Instant transaction processing with immediate exception detection and alerts.

Enterprise Security

Bank-grade security with encrypted data transmission and access controls.

Works with your existing tools

Connect payment gateways, banks, and accounting software in minutes—no complex setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Payment Gateway Reconciliation Software | UAE Automated

Universal Payment Gateway Integration & Reconciliation Hub

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

E-commerce & Retail Payment Reconciliation Hub

Complete E-commerce, Retail & Multi-Channel Payment Reconciliation

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

How does free zone payment reconciliation work for UAE free zone companies?

Free zone payment reconciliation provides specialized solutions for UAE free zone enterprises. Our UAE free zone financial solutions platform handles cross-border transactions, multi-currency operations, tax-efficient payment processing, and compliance with free zone regulations across all UAE free zones.

Which UAE free zones are supported by the reconciliation platform?

We support all major UAE free zones including Dubai Airport Free Zone (DAFZA), Jebel Ali Free Zone (JAFZA), Abu Dhabi Global Market (ADGM), Dubai International Financial Centre (DIFC), Sharjah Airport International Free Zone, and others, providing specialized compliance for each free zone's requirements.

How does the platform handle tax-efficient payment processing for free zone companies?

Our free zone compliance automation platform optimizes payment structures for tax efficiency, handles VAT exemptions where applicable, processes duty-free transactions, and ensures compliance with free zone tax regulations while maximizing tax benefits.

Can the system process cross-border payments and international transactions?

Yes, our cross-border payment processing platform specializes in international transactions for free zone companies, handles multi-currency payments, applies appropriate exchange rates, and ensures compliance with both UAE and international regulations.

How does free zone reconciliation ensure compliance with different free zone authorities?

Our platform maintains compliance with each free zone authority's specific requirements, provides tailored reporting for different zones, handles varying regulatory standards, and ensures all reconciliation processes meet individual free zone compliance requirements.

Does the platform support 100% foreign ownership transaction tracking for free zones?

Yes, our free zone reconciliation platform supports 100% foreign ownership structures, tracks international investment flows, handles repatriation of profits, and provides reporting required for foreign-owned free zone entities.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

Payment Reconciliation Software | UAE Automated Solution

Best Payment Reconciliation Software for UAE Businesses

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses