Predictive Analytics for Payment Reconciliation - AI Insights

Revolutionary predictive analytics for payment reconciliation processes. Leverage machine learning algorithms to forecast payment trends, predict reconciliation exceptions, optimize cash flow planning, and deliver actionable business intelligence from payment data.

See ReconcileOS in Action

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Everything you need to automate reconciliation

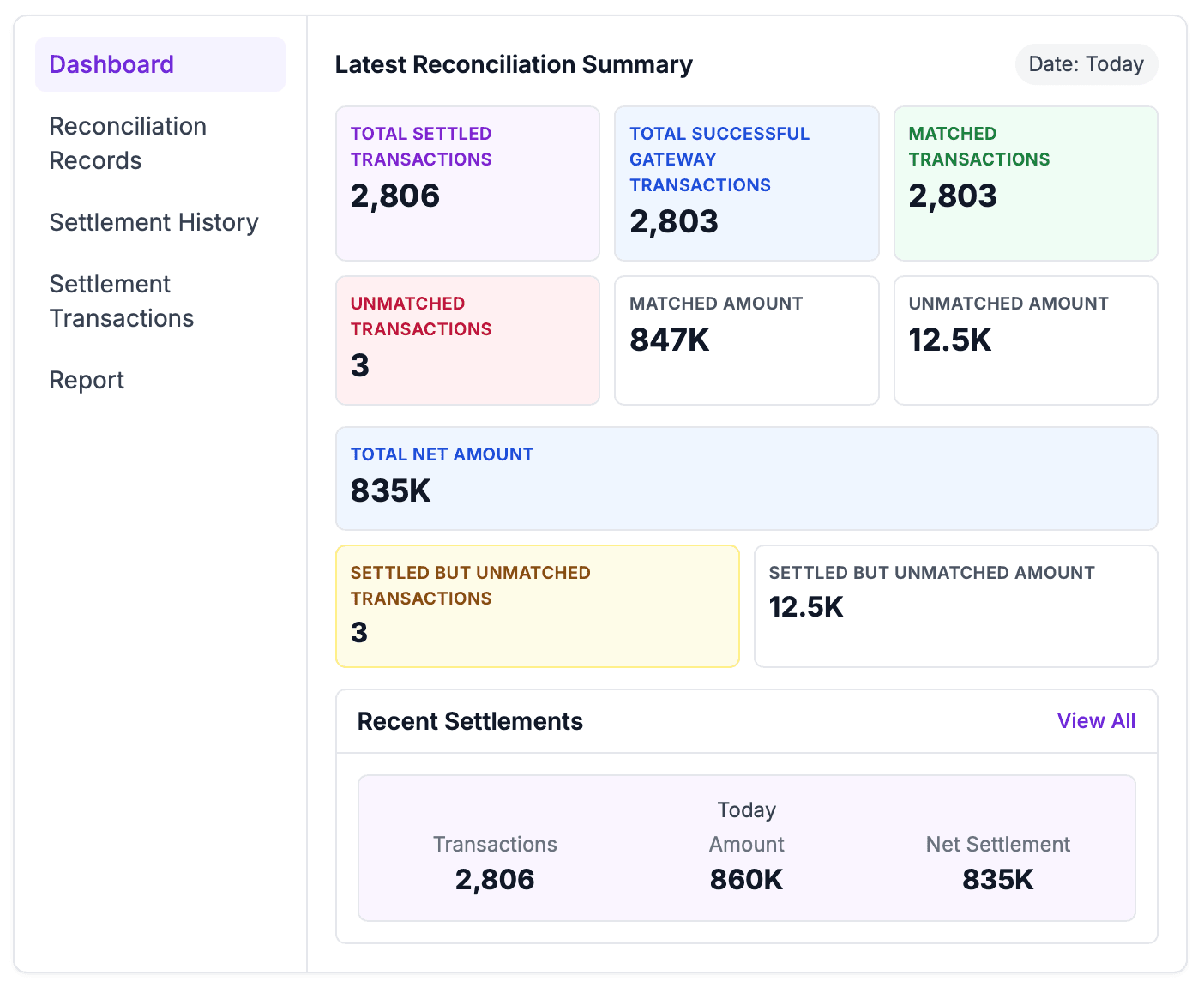

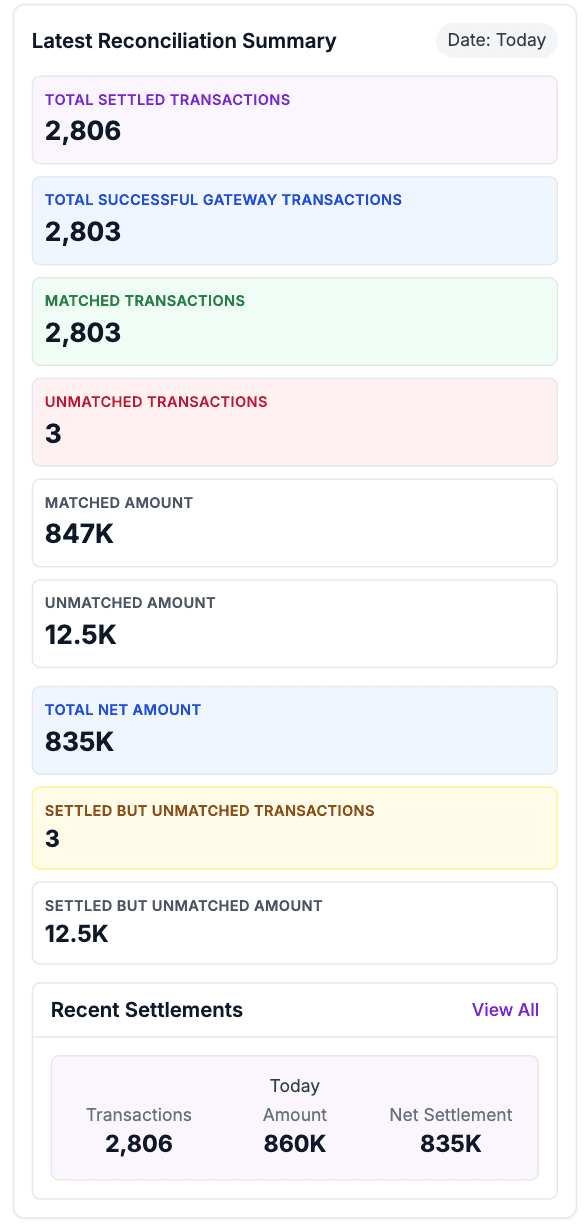

Match gateway, bank, and ledger data automatically. Review only exceptions.

Settlement Transactions

Four‑way matching across gateway files, bank statements, ledger entries, and orders.

Settlement History

Daily close with variances highlighted and net settlement computed automatically.

Reconciliation Records

Audit‑ready trails with exports. Every match and adjustment is logged.

Reports

Scheduled PDF/CSV delivery and ERP‑friendly exports.

Real-time Processing

Instant transaction processing with immediate exception detection and alerts.

Enterprise Security

Bank-grade security with encrypted data transmission and access controls.

Works with your existing tools

Connect payment gateways, banks, and accounting software in minutes—no complex setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Payment Gateway Reconciliation Software | UAE Automated

Universal Payment Gateway Integration & Reconciliation Hub

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

E-commerce & Retail Payment Reconciliation Hub

Complete E-commerce, Retail & Multi-Channel Payment Reconciliation

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

How does predictive analytics improve payment reconciliation processes?

Predictive analytics payment reconciliation leverages machine learning algorithms to forecast payment trends, predict reconciliation exceptions, optimize cash flow planning, and deliver actionable business intelligence. Our AI payment forecasting platform transforms historical payment data into predictive insights for better financial decision-making.

What types of predictions can the analytics platform provide for payment reconciliation?

Our machine learning reconciliation platform predicts settlement delays, forecasts exception volumes, identifies potential reconciliation failures, estimates processing times, and anticipates cash flow patterns based on historical data and market trends.

How does AI-powered forecasting help with cash flow management?

Our AI payment forecasting system predicts incoming payments, estimates settlement timings, forecasts payment failures, and provides cash flow projections that help businesses optimize working capital, plan investments, and maintain healthy cash flow management.

Can the platform predict and prevent reconciliation exceptions before they occur?

Yes, our payment trend analysis system identifies patterns that lead to reconciliation exceptions, provides early warning alerts, suggests preventive actions, and helps teams proactively address potential issues before they impact the reconciliation process.

How does predictive analytics improve payment processing efficiency?

Our platform optimizes processing workflows, predicts peak transaction periods, identifies bottlenecks, and recommends process improvements based on predictive analytics, resulting in faster reconciliation cycles and improved operational efficiency.

What business intelligence insights are available from payment reconciliation data?

Our business intelligence platform provides customer payment behavior analysis, seasonal trend identification, processor performance comparisons, cost optimization opportunities, and strategic insights for improving payment operations and financial performance.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

Payment Reconciliation Software | UAE Automated Solution

Best Payment Reconciliation Software for UAE Businesses

UAE's #1 Payment Reconciliation Platform

Complete Payment Reconciliation Hub for UAE Businesses

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses