Small Business Cost Optimization - Reduce Processing Costs

Optimize payment processing costs for UAE small businesses. Reduce transaction fees, eliminate manual processing costs, automate reconciliation workflows, and maximize profitability with cost-effective payment solutions tailored for SMEs.

See ReconcileOS in Action

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Everything you need to automate reconciliation

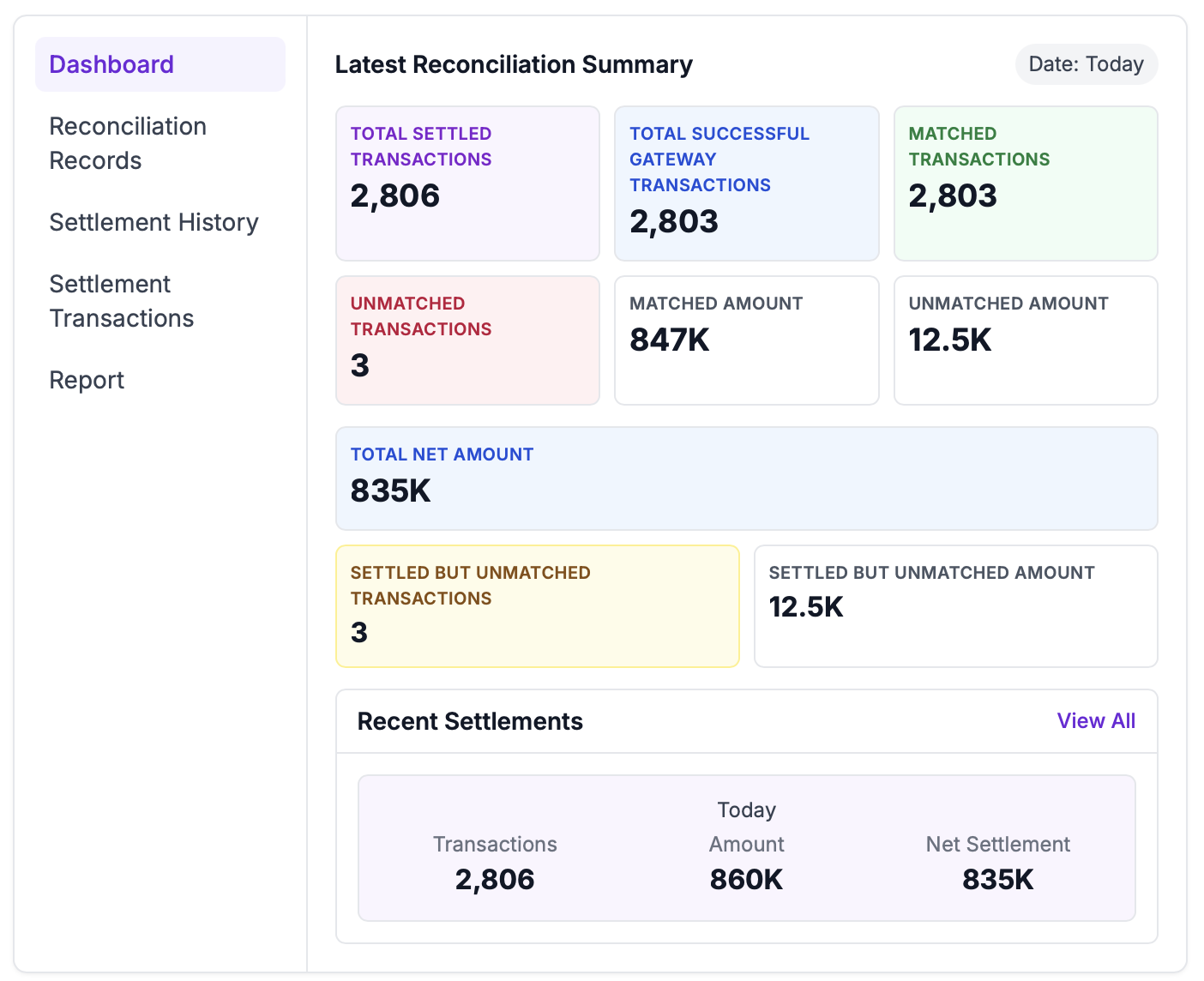

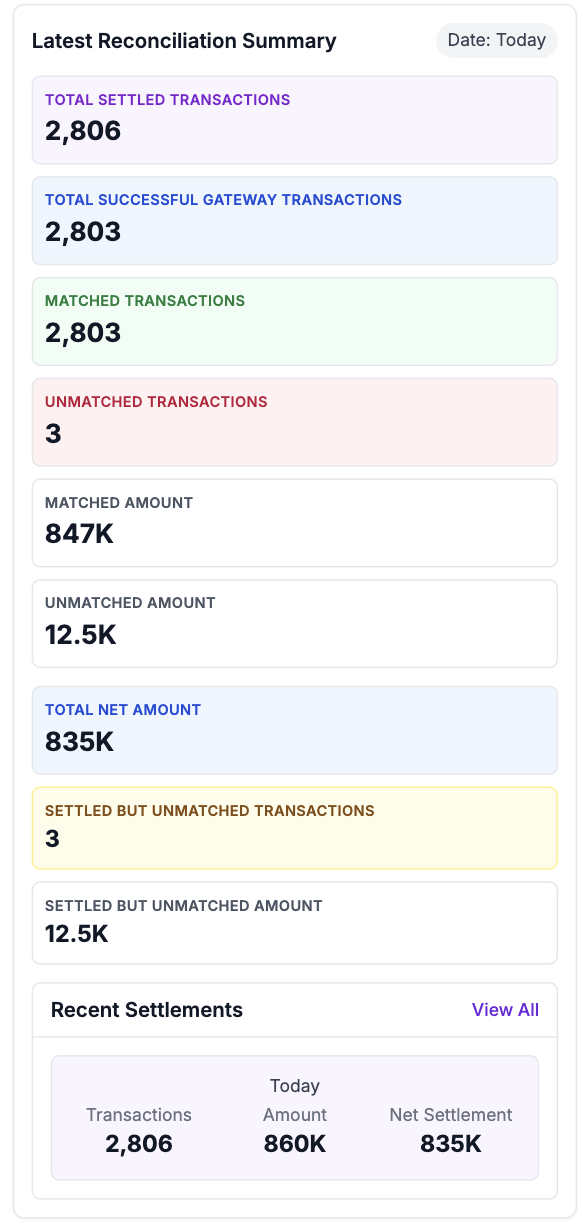

Match gateway, bank, and ledger data automatically. Review only exceptions.

Settlement Transactions

Four‑way matching across gateway files, bank statements, ledger entries, and orders.

Settlement History

Daily close with variances highlighted and net settlement computed automatically.

Reconciliation Records

Audit‑ready trails with exports. Every match and adjustment is logged.

Reports

Scheduled PDF/CSV delivery and ERP‑friendly exports.

Real-time Processing

Instant transaction processing with immediate exception detection and alerts.

Enterprise Security

Bank-grade security with encrypted data transmission and access controls.

Works with your existing tools

Connect payment gateways, banks, and accounting software in minutes—no complex setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

Reducing Payment Reconciliation Costs by 80% | Complete Guide

Discover proven strategies to reduce payment reconciliation costs by 80% in the UAE. Expert guide on automation and process optimization.

Startup Payment Reconciliation Guide - Scale Your Business

Essential Payment Management for Growing UAE Startups

Micro-Enterprise Reconciliation - Ultra-Small Business Automation

Affordable Payment Management for Micro-Businesses

ROI Analysis: The True Cost of Manual vs Automated Payment Reconciliation

Comprehensive ROI analysis comparing manual and automated payment reconciliation. Learn to calculate true costs and justify automation investment.

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

How can UAE small businesses optimize payment processing costs?

Small business cost optimization focuses on reducing transaction fees, eliminating manual processing costs, and maximizing profitability. Our UAE SME payment cost reduction platform analyzes payment patterns, negotiates better rates, automates reconciliation workflows, and provides cost-effective payment solutions tailored for small businesses.

What are the hidden costs in payment processing for small businesses?

Hidden costs include manual reconciliation labor, failed transaction fees, currency conversion charges, chargeback penalties, and compliance costs. Our payment processing cost optimization platform identifies these hidden expenses and implements automated solutions to reduce overall payment processing costs by up to 40%.

How does automation improve small business profitability?

Automation eliminates manual reconciliation costs, reduces errors, speeds up cash flow, and frees up staff time for revenue-generating activities. Our small business profitability platform typically saves 15-20 hours per month in manual work while improving financial accuracy and cash flow management.

Can small businesses negotiate better payment processing rates?

Yes, our platform provides transaction volume analysis, rate comparison tools, and negotiation support to help small businesses secure better payment processing rates. We leverage collective bargaining power and provide data-driven insights for rate negotiations with payment processors.

How does the platform help SMEs reduce payment gateway fees?

Our SME financial automation platform optimizes payment routing, identifies the most cost-effective gateways for different transaction types, implements smart retry logic, and provides detailed fee analysis to minimize gateway costs while maintaining payment success rates.

What ROI can small businesses expect from payment cost optimization?

UAE small businesses typically see 25-40% reduction in payment processing costs, 60-80% reduction in reconciliation time, and improved cash flow within 2-3 months. The platform typically pays for itself within the first quarter through cost savings and efficiency gains.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

UAE's #1 Payment Reconciliation Platform

Automate PayTabs, Telr & Network International Reconciliation

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses

Enterprise Banking Reconciliation for UAE Banks

Core Banking Integration & Real-Time Processing