Sole Proprietorship Payment Management - Individual Business

Comprehensive payment management solutions for UAE sole proprietorships. Handle personal business transactions, separate business and personal finances, maintain compliance records, and simplify tax reporting for individual business owners.

See ReconcileOS in Action

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Everything you need to automate reconciliation

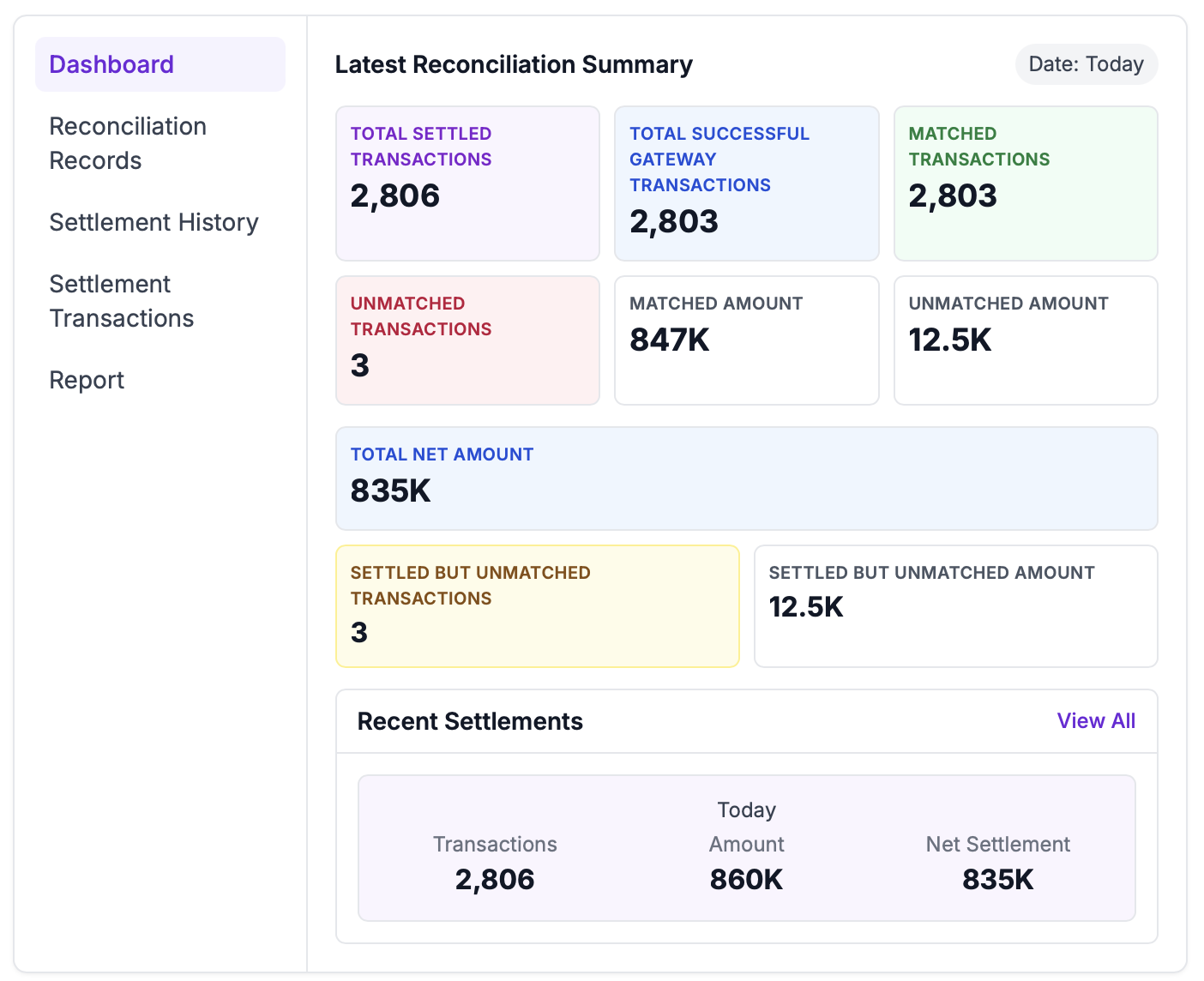

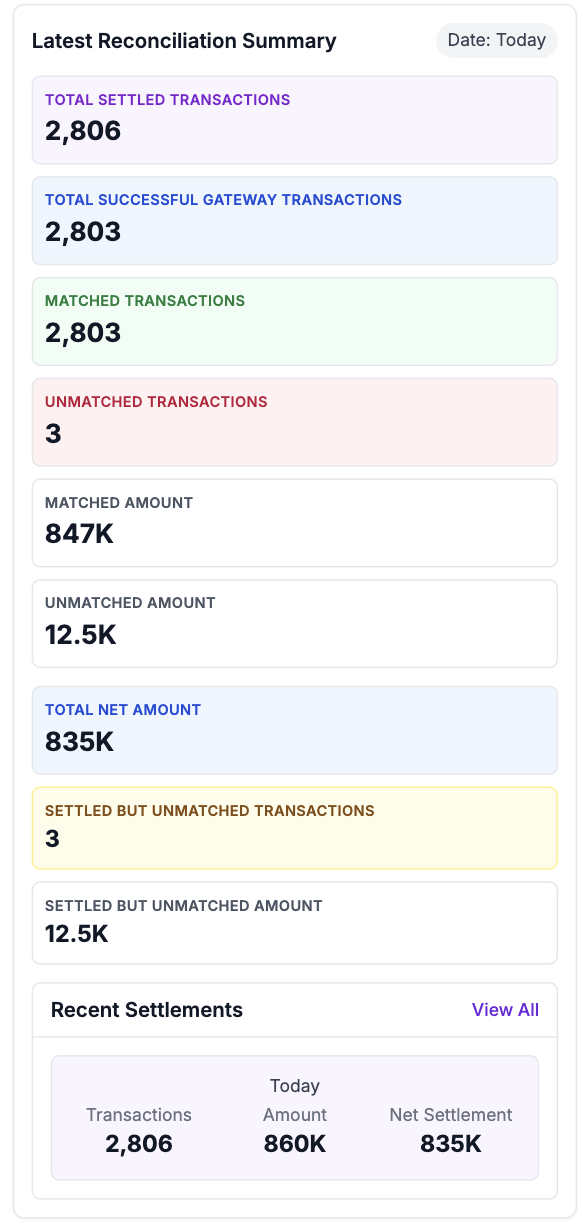

Match gateway, bank, and ledger data automatically. Review only exceptions.

Settlement Transactions

Four‑way matching across gateway files, bank statements, ledger entries, and orders.

Settlement History

Daily close with variances highlighted and net settlement computed automatically.

Reconciliation Records

Audit‑ready trails with exports. Every match and adjustment is logged.

Reports

Scheduled PDF/CSV delivery and ERP‑friendly exports.

Real-time Processing

Instant transaction processing with immediate exception detection and alerts.

Enterprise Security

Bank-grade security with encrypted data transmission and access controls.

Works with your existing tools

Connect payment gateways, banks, and accounting software in minutes—no complex setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

Startup Payment Reconciliation Guide - Scale Your Business

Essential Payment Management for Growing UAE Startups

Cross-Border Payment Reconciliation: Managing International Transactions

Master cross-border payment reconciliation for UAE businesses. Learn multi-currency processing, settlement delays, and FX rate management.

Mobile Payment Reconciliation: Apple, Google, Samsung Pay

Master mobile payment reconciliation for Apple Pay, Google Pay, and Samsung Pay. Learn integration techniques and tokenization handling for UAE.

UAE Payment Reconciliation Compliance: Central Bank

Complete guide to UAE payment reconciliation compliance. Learn Central Bank regulations, FTA reporting standards, and automated compliance solutions.

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

How does payment management work for UAE sole proprietorships?

Sole proprietorship payment management provides comprehensive payment solutions for individual business owners in the UAE. Our individual business payments UAE platform handles personal business transactions, separates business and personal finances, maintains compliance records, and simplifies tax reporting for sole traders.

How can sole proprietors separate business and personal finances effectively?

Our personal business reconciliation platform provides separate business accounts, automated transaction categorization, business expense tracking, and clear financial separation. Sole proprietors can maintain professional financial records while keeping personal and business finances distinct for tax and legal purposes.

What payment processing options are available for UAE sole traders?

UAE sole traders can use business bank accounts, payment gateways, mobile payment solutions, and cash handling systems. Our sole trader payment processing platform provides guidance on the most suitable options based on business type, customer preferences, and compliance requirements.

How does the platform help with UAE tax reporting for sole proprietorships?

Our individual business payment platform automatically categorizes business expenses, tracks revenue, generates tax-ready reports, and ensures compliance with UAE Federal Tax Authority requirements. Sole proprietors can easily prepare tax returns and maintain audit-ready financial records.

Can sole proprietors access professional financial reporting features?

Yes, our sole proprietorship platform provides professional financial reports, profit and loss statements, cash flow analysis, and business performance metrics. Individual business owners can access enterprise-level reporting tools designed for single-person business operations.

How does the platform support sole proprietorship business growth?

Our platform scales with sole proprietorship growth, offering features like team member addition, multi-location support, advanced reporting, and integration options. Sole proprietors can expand their operations while maintaining the same payment management platform throughout their business journey.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

UAE's #1 Payment Reconciliation Platform

Automate PayTabs, Telr & Network International Reconciliation

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses

Enterprise Banking Reconciliation for UAE Banks

Core Banking Integration & Real-Time Processing