Startup Payment Reconciliation Guide - Scale Your Business

Complete startup payment reconciliation guide for UAE entrepreneurs. Learn to manage cash flow, automate invoicing, handle investor payments, scale payment processing, and maintain accurate financial records as your startup grows.

See ReconcileOS in Action

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Everything you need to automate reconciliation

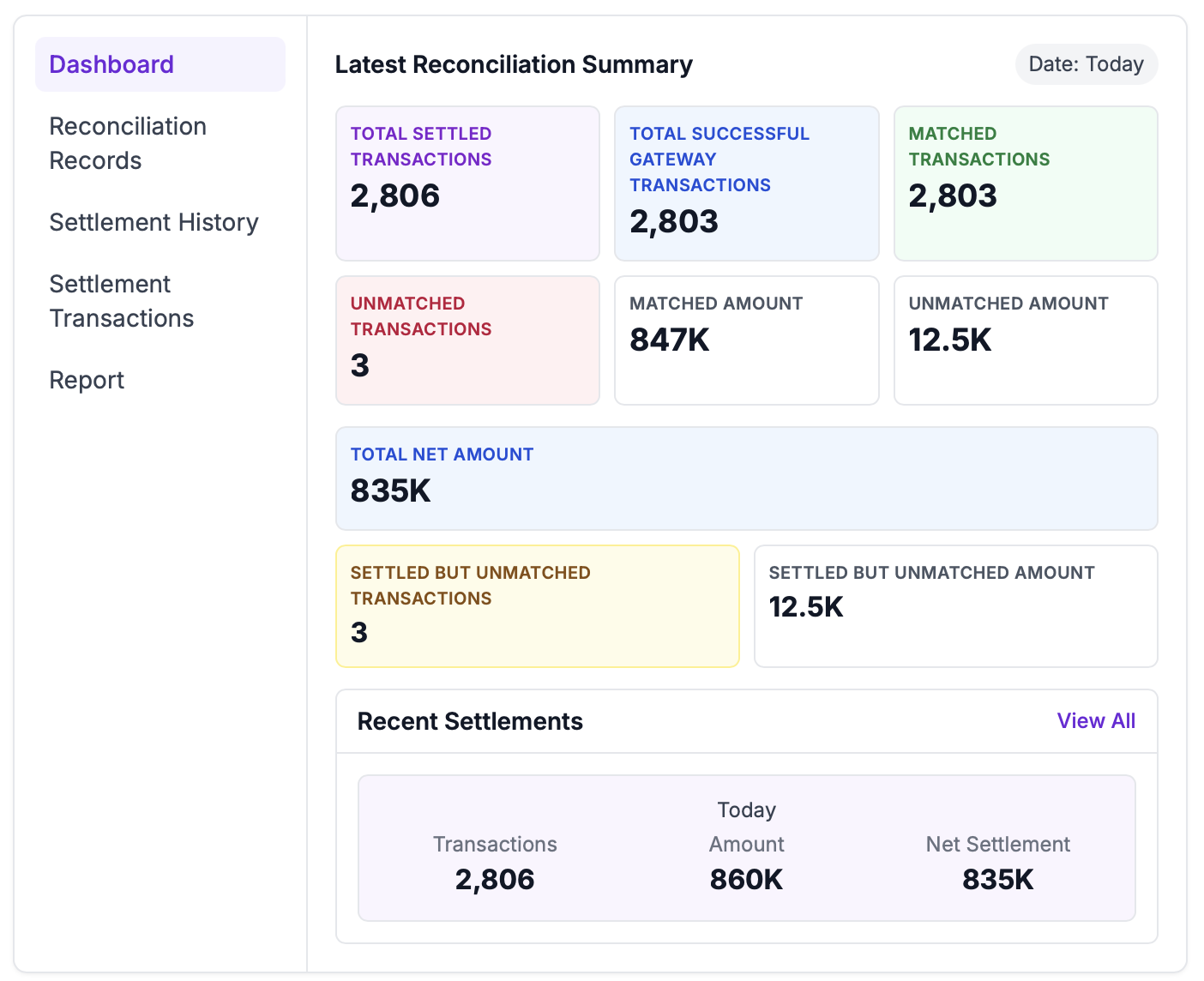

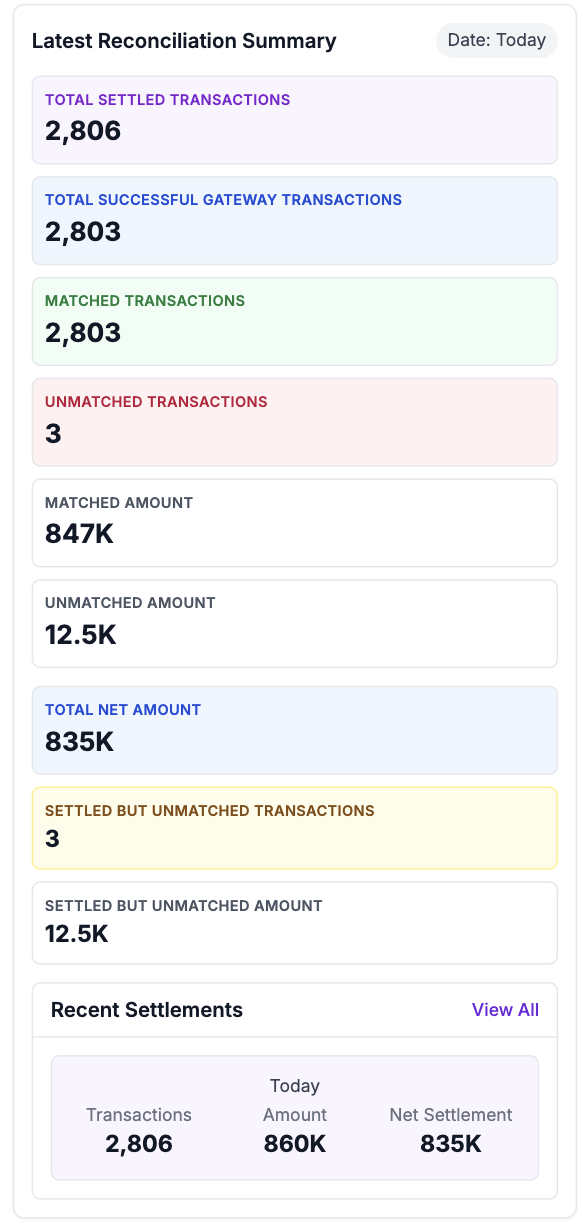

Match gateway, bank, and ledger data automatically. Review only exceptions.

Settlement Transactions

Four‑way matching across gateway files, bank statements, ledger entries, and orders.

Settlement History

Daily close with variances highlighted and net settlement computed automatically.

Reconciliation Records

Audit‑ready trails with exports. Every match and adjustment is logged.

Reports

Scheduled PDF/CSV delivery and ERP‑friendly exports.

Real-time Processing

Instant transaction processing with immediate exception detection and alerts.

Enterprise Security

Bank-grade security with encrypted data transmission and access controls.

Works with your existing tools

Connect payment gateways, banks, and accounting software in minutes—no complex setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

Why 90% of UAE Businesses Lose Money on Payment Reconciliation

A Dubai e-commerce business discovered they'd been losing AED 50,000 monthly due to silent payment failures. Here's how automated reconciliation can prevent this.

Disaster Recovery Planning for Payment Reconciliation Systems

Disaster recovery planning for payment reconciliation systems. Learn backup strategies, failover procedures, and business continuity planning.

UAE Payment Reconciliation Compliance: Central Bank

Complete guide to UAE payment reconciliation compliance. Learn Central Bank regulations, FTA reporting standards, and automated compliance solutions.

ROI Analysis: The True Cost of Manual vs Automated Payment Reconciliation

Comprehensive ROI analysis comparing manual and automated payment reconciliation. Learn to calculate true costs and justify automation investment.

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

How does payment reconciliation help UAE startups scale their business finances?

Startup payment reconciliation guide provides essential financial management tools for growing UAE entrepreneurs. Our UAE startup financial management platform automates cash flow tracking, investor payment monitoring, and scalable payment processing, helping startups maintain accurate financial records as they grow from seed to Series A and beyond.

What payment processing challenges do UAE startups typically face?

UAE startups commonly struggle with manual reconciliation, cash flow visibility, investor reporting, and scalable payment infrastructure. Our startup payment processing platform addresses these challenges with automated workflows, real-time financial dashboards, and growth-ready payment solutions designed for the UAE startup ecosystem.

How can startups automate invoicing and payment collection in the UAE?

Our entrepreneur payment automation platform provides automated invoicing, payment gateway integration, subscription billing, and customer payment tracking. Startups can streamline revenue collection, reduce manual work, and focus on core business growth while maintaining professional financial operations.

Does the platform support investor payment tracking and funding round reconciliation?

Yes, our startup cash flow management system tracks investor payments, funding round disbursements, equity transactions, and convertible note processing. Startups can maintain transparent financial records for investors, accelerate due diligence, and prepare accurate financial reports for fundraising activities.

How does the startup reconciliation platform handle different business models?

Our platform adapts to various startup business models including SaaS subscriptions, e-commerce, marketplace transactions, B2B services, and freemium models. Each reconciliation workflow is customized to handle specific revenue streams, payment timings, and financial reporting requirements.

Can startups integrate payment reconciliation with popular business tools?

Absolutely. Our startup financial management platform integrates with popular tools like Slack, Notion, Google Workspace, and startup-friendly accounting software, ensuring seamless workflow integration and real-time financial visibility for growing UAE startups.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

UAE's #1 Payment Reconciliation Platform

Automate PayTabs, Telr & Network International Reconciliation

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses

Enterprise Banking Reconciliation for UAE Banks

Core Banking Integration & Real-Time Processing