Dubai Payment Reconciliation Services

Expert payment reconciliation services tailored for Dubai's business environment. Local expertise, UAE compliance, and dedicated support for Dubai enterprises and SMEs.

See ReconcileOS in Action

Watch how our automated reconciliation platform transforms hours of manual work into minutes of intelligent review

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

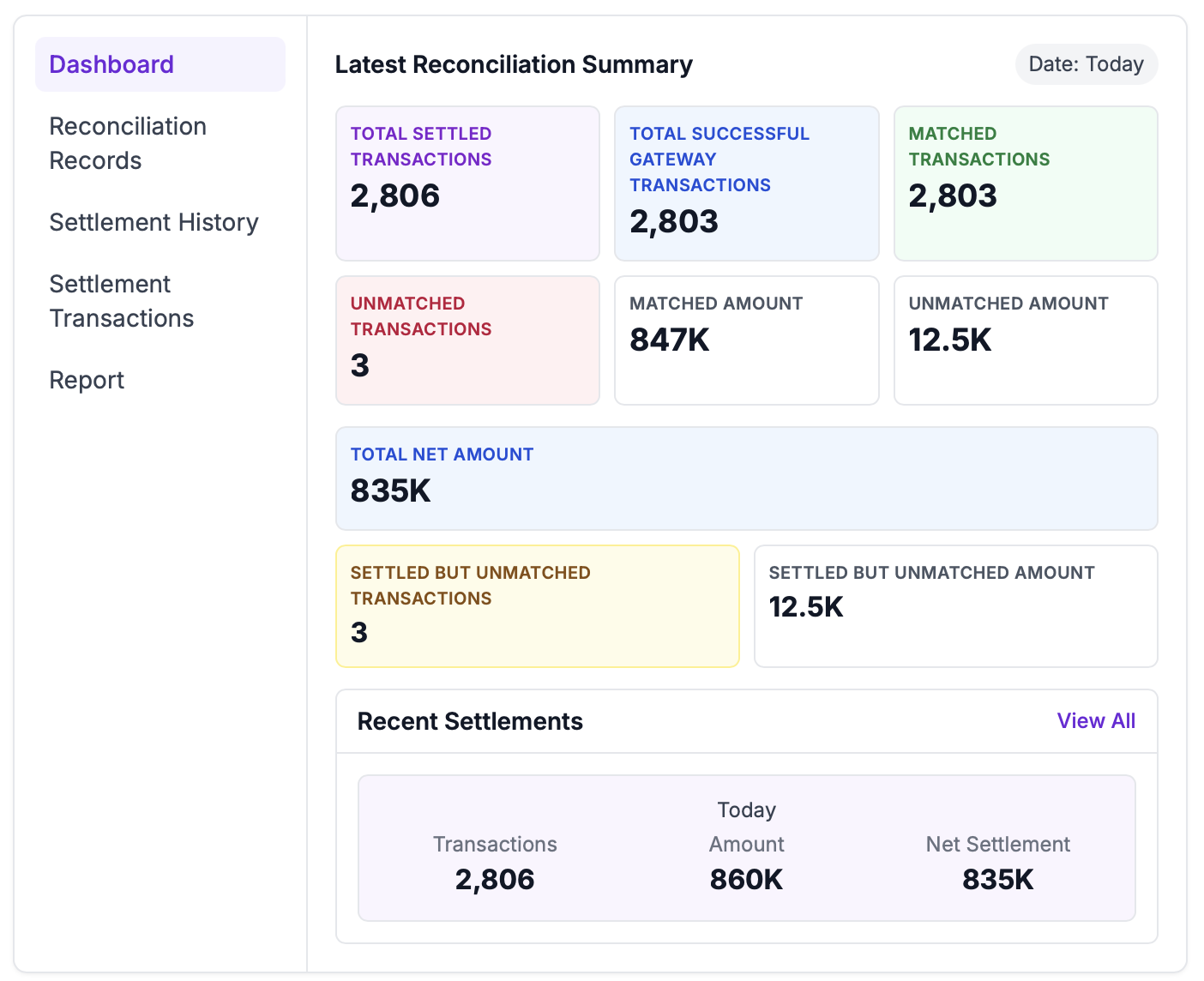

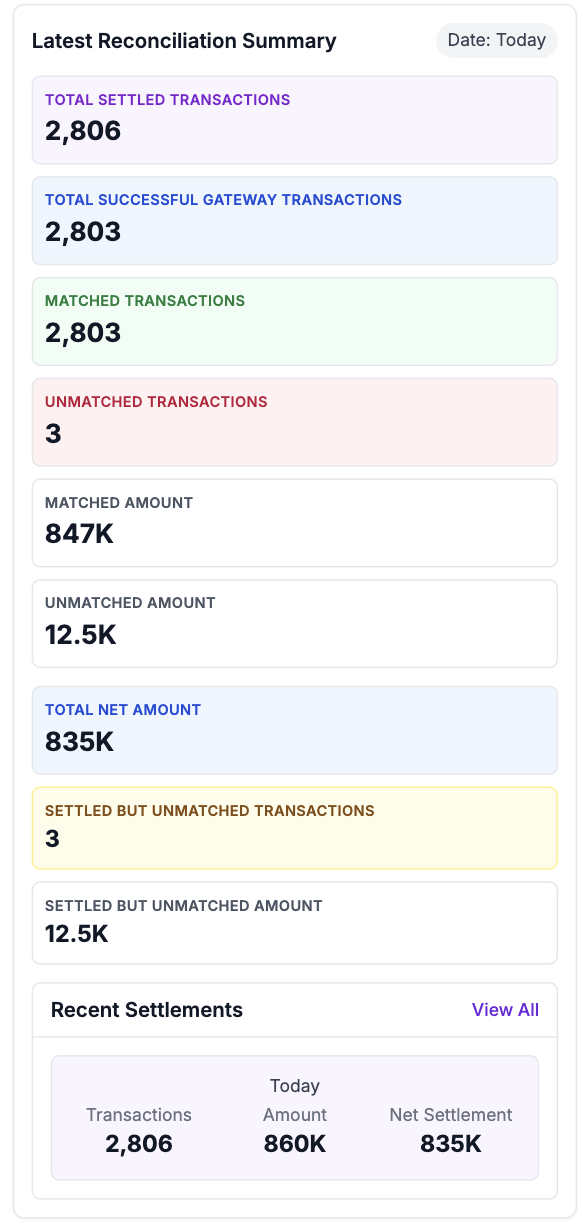

Everything you need to automate reconciliation

Match gateway, bank, and ledger data automatically. Review only exceptions.

Settlement Transactions

Four‑way matching across gateway files, bank statements, ledger entries, and orders.

Settlement History

Daily close with variances highlighted and net settlement computed automatically.

Reconciliation Records

Audit‑ready trails with exports. Every match and adjustment is logged.

Reports

Scheduled PDF/CSV delivery and ERP‑friendly exports.

Real-time Processing

Instant transaction processing with immediate exception detection and alerts.

Enterprise Security

Bank-grade security with encrypted data transmission and access controls.

Works with your existing tools

Connect payment gateways, banks, and accounting software in minutes—no complex setup.

Ready to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Related Solutions

Why 90% of UAE Businesses Lose Money on Payment Reconciliation

A Dubai e-commerce business discovered they'd been losing AED 50,000 monthly due to silent payment failures. Here's how automated reconciliation can prevent this.

Disaster Recovery Planning for Payment Reconciliation Systems

Disaster recovery planning for payment reconciliation systems. Learn backup strategies, failover procedures, and business continuity planning.

UAE Payment Reconciliation Compliance: Central Bank

Complete guide to UAE payment reconciliation compliance. Learn Central Bank regulations, FTA reporting standards, and automated compliance solutions.

ROI Analysis: The True Cost of Manual vs Automated Payment Reconciliation

Comprehensive ROI analysis comparing manual and automated payment reconciliation. Learn to calculate true costs and justify automation investment.

Frequently Asked Questions

Everything you need to know about ReconcileOS and automated reconciliation

What are Dubai payment reconciliation services?

These are specialized services for Dubai businesses to automate, manage, and optimize payment reconciliation across all channels.

Is local support available for Dubai businesses?

Yes, we provide dedicated local support, onboarding, and training for businesses operating in Dubai.

How does the service ensure compliance with Dubai regulations?

Our services are designed to comply with Dubai Financial Services Authority (DFSA) and UAE Central Bank regulations.

Can the service handle both online and offline payments?

Yes, we reconcile payments from e-commerce, POS, and mobile channels for a complete financial picture.

What is the typical ROI for Dubai payment reconciliation services?

Most Dubai businesses see a return on investment within 3-6 months due to reduced errors, faster closing, and improved cash flow.

Still have questions?

Our team is here to help you understand how ReconcileOS can transform your reconciliation process

Contact SupportReady to simplify reconciliation?

Tell us a bit about your setup and we’ll show you a tailored demo.

Explore More Use Cases

Discover how ReconcileOS can solve different payment reconciliation challenges for UAE businesses

UAE's #1 Payment Reconciliation Platform

Automate PayTabs, Telr & Network International Reconciliation

Automate PayTabs Reconciliation in Minutes

Complete PayTabs Settlement Automation

Complete Telr Reconciliation Automation

Seamless Telr Automation for Dubai Businesses

Network International Reconciliation Made Simple

Enterprise-Grade NI Settlement Processing

Dubai's Advanced Settlement Automation Platform

Multi-Gateway Settlement Processing for Dubai Businesses

Enterprise Banking Reconciliation for UAE Banks

Core Banking Integration & Real-Time Processing